FG Merger II Corp. is a newly organized blank check company formed as a Nevada corporation for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses.

We intend to prioritize combinations where we see significant opportunity for attractive risk adjusted investor returns driven by the dynamics of a public listing. Although we will not limit our search to any particular geography or industry, we will concentrate our efforts on identifying businesses in the financial services industry in North America.

Our team brings a combination of: 1) experience as founders, leaders, operators and directors of financial services companies, 2) decades of buy side experience in financial services with an extensive network of contacts, and 3) over a decade of experience working in all aspects of SPACs.

FG Merger II Corp. is a newly organized blank check company formed as a Nevada corporation for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses.

We intend to prioritize combinations where we see significant opportunity for attractive risk adjusted investor returns driven by the dynamics of a public listing. Although we will not limit our search to any particular geography or industry, we will concentrate our efforts on identifying businesses in the financial services industry in North America.

Our team brings a combination of: 1) experience as founders, leaders, operators and directors of financial services companies, 2) decades of buy side experience in financial services with an extensive network of contacts, and 3) over a decade of experience working in all aspects of SPACs.

Strong/MDI is one of the leading cinema screen manufacturers in the world. Strong/MDI produces and sells specialty screens, screen support structures, and other film exhibition equipment for customers globally.

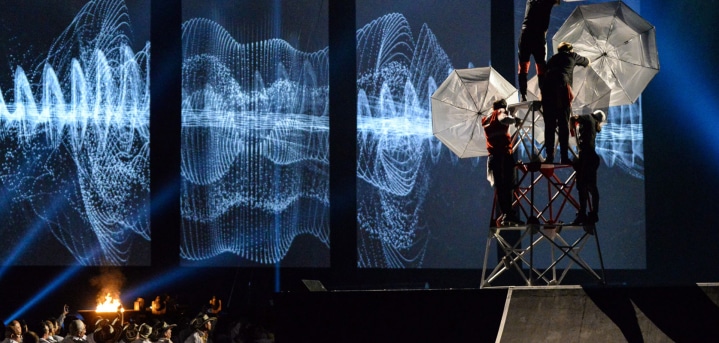

Strong Studios, which will be based in New York, will develop and produce original feature films and television series, as well as acquire third party rights to content for global multiplatform distribution.

Strong Studios, which will be based in New York, will develop and produce original feature films and television series, as well as acquire third party rights to content for global multiplatform distribution.

STS offers a comprehensive suite of cinema-focused services, including installation, maintenance, and technical support, to exhibitors throughout the United States. They offer a variety of products ranging from digital signage to projection.

Firefly connects cities with its dynamic smart media platform. The company works with taxi companies and rideshare drivers to install its proprietary advertising displays atop their vehicles and providing an additional revenue stream to maximize their drive time.

Firefly’s technology delivers the right message at the right time, cutting through the noise of a booming space and leading to highly effective campaign-engagement.

GreenFirst Forest Products invests in the global forest products industry. The company owns a sawmill in Kenora, Ontario and its operators are experienced in the acquisition and turnaround of sawmill assets.

We believe this industry offers favorable cyclical and secular dynamics, with increased demand for lumber in the housing sector and lumbers “green” advantage as a building material.

FG Financial Group, Inc. is implementing business plans to operate as a diversified insurance, reinsurance and investment management holding company, incorporated in Delaware. The Company endeavors to make opportunistic and value-oriented investments in insurance, reinsurance and related businesses.

The Company conducts principal business operations through its subsidiaries and affiliates.